Get upto 4%* on our Savings Account Balances with Gramin CSP Services.

More DetailsUpdates:

Dear Customer, We have launched Video KYC facility for New customer to open savings ac

Get upto 4%* on our Savings Account Balances with Gramin CSP Services.

More DetailsDear Customer, We have launched Video KYC facility for New customer to open savings ac

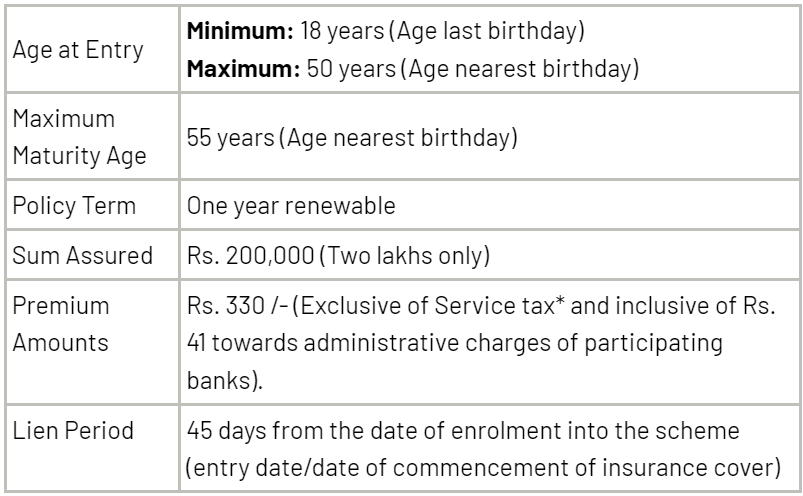

This is a non-linked, non-participating, one year renewable group term insurance product. This product has been designed to meet the requirements of Government of India’s “Pradhan Mantri Jeevan Jyoti Bima Yojana” (PMJJBY) scheme. The scheme will be administered by Banks and be guided by the scheme rules as specified by the Government of India from time to time.

The insurance cover under this product will start from the date of debit of premium from the insured member’s account for joining the scheme

Protection at an affordable cost

Instant processing: No medical examination required

Easy enrolment: Enrolment based on a simplified proposal form

Death Benefit: In the unfortunate event of death of the insured member during the period of cover, the sum assured will be paid. The death benefit for a member under Pradhan Mantri Jeevan Jyoti Bima Yojana cannot exceed Rs. 200,000 even in case the member is covered through multiple bank accounts or through multiple insurers. In such an event, the claim will be payable for the first application (based on the date of enrolment) and the premium on the subsequent covers is liable to be forfeited.

Maturity/ Surrender Benefit: There is no maturity or surrender benefit under this plan.

Enrolment: The date of commencement of insurance cover is the date of debit of premium from the insured member’s account for joining the scheme and the insurance cover will be up to 31st May of the subsequent year. Thereafter, the cover can be renewed on the 1st of June every year by debiting the premium to your bank account. The premium is subject to change as specified by the Government of India from time to time.

Exclusions: For new members enrolling into the scheme the risk will not be covered during the first 45 days from the date of enrollment into the scheme (lien period) and in case of death (other than due to accident) during lien period, no claim would be admissible

Tax Benefits: Income Tax benefits/exemptions are as per the applicable income tax laws in India, which are subject to change from time to time. Please consult your tax advisor for details

Mobile banking application with new & exciting features.