Get upto 4%* on our Savings Account Balances with Gramin CSP Services.

More DetailsUpdates:

Dear Customer, We have launched Video KYC facility for New customer to open savings ac

Get upto 4%* on our Savings Account Balances with Gramin CSP Services.

More DetailsDear Customer, We have launched Video KYC facility for New customer to open savings ac

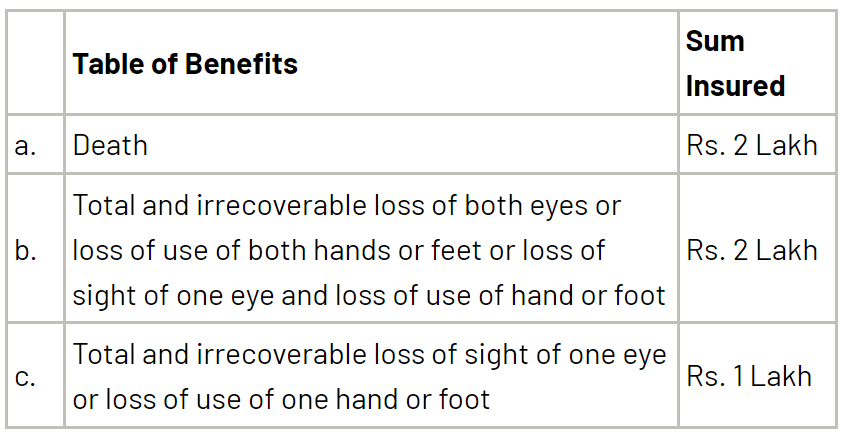

The scheme will be a one year cover, renewable from year to year, Accident Insurance Scheme offering accidental death and disability cover for death or disability on account of an accident.

Scope of coverage: All savings bank account holders in the age 18 to 70 years in participating banks will be entitled to join. In case of multiple saving bank accounts held by an individual in one or different banks, the person would be eligible to join the scheme through one savings bank account only.

Any person between the age of 18 and 70 with a savings bank account and Aadhaar Card can join the scheme. A person will need to fill out a simple form, mentioning the name of the nominee and linking the Aadhaar Card to the bank account. The person will need to submit the form each year before 1st June to continue the scheme. With this, the account can be easily activated and the entire premium due will be auto-debited from his or her account. In other words, all a person has to do is to open a bank account and then ensure the availability of at least Rs. 12/- before 1st June of each year to ensure automatic renewal of the scheme. A person has the option to go in for a long-term inclusion under the scheme by instructing the bank to auto-renew the scheme every year.

For processing the application, the demographic details and the nominee name, nominee relationship and nominee date of birth will be taken from the details present in the savings account. In case, the nominee details are not available in core banking records, the confirmation will not be taken ahead for processing. Customer may then apply from the nearest branch / netbanking. In case, the auto debit of the premium fails due to insufficient funds or other reasons, the insurance cover ceases to be in-force

2 LAKH in the case of Death Insurance

2 LAKH in the case of Both Eyes Loss or Both Hand Loss or Both Foot Loss

1 LAKH in the case of One Eyes Loss or One Hand Loss or One Foot Loss

Mobile banking application with new & exciting features.